Most people in finance pitch products or confuse you with jargon, but Richard Canfield does not.

I’ve known Richard for years. We’ve shared stages, spoken to rooms of tradespeople, real estate investors, and business owners. I’ve been a guest on his podcast, and from the start, I noticed something rare: he simplifies complex financial systems without ever pushing a sale.

From Tools to Finance: An Unconventional Path

Richard was a Journeyman Electrician: running crews, solving problems, and working with his hands. He also got into real estate early. Managed properties. Learned the hard way how cash flow works.

Later, he helped first-time investors as a Realtor.

So when he talks about money, he’s speaking from experience, not theory.

Everything changed for him in 2009 when he read Becoming Your Own Banker by R. Nelson Nash. Richard says it felt like “a fog had been lifted.”

The book showed him how to build wealth outside the banks, using principles most advisors never talk about.

He didn’t stop at reading it.

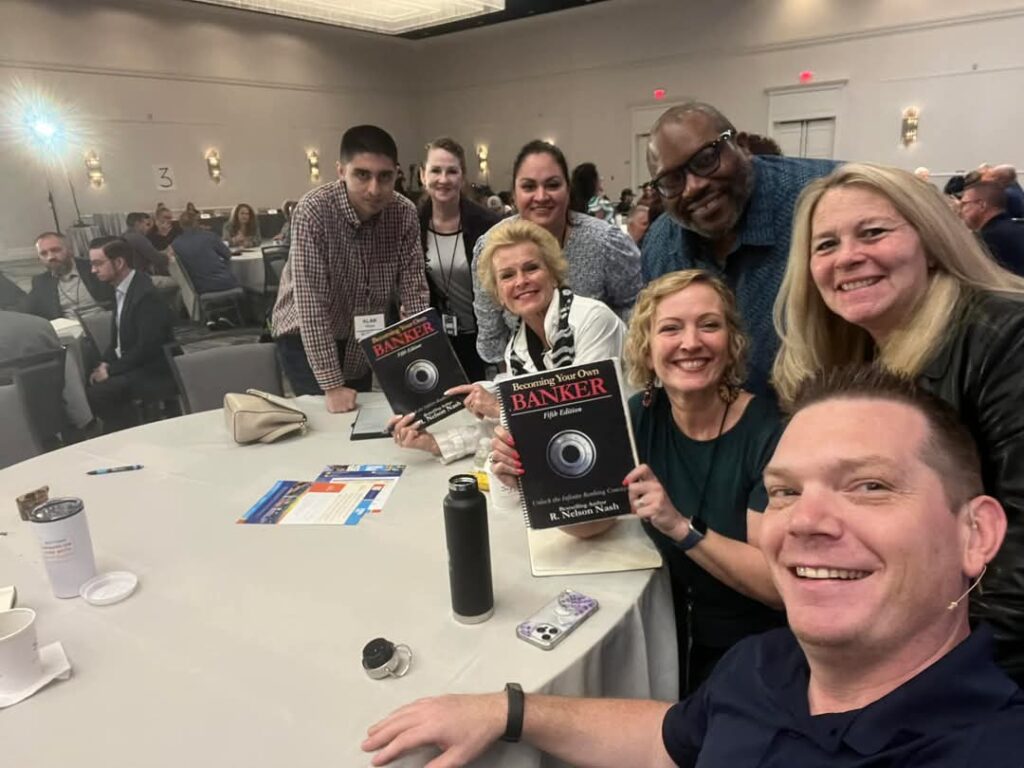

He teamed up with his friend Jayson Lowe, and they started teaching the Infinite Banking Concept across Canada.

Mastering and Teaching Infinite Banking

The tool Richard uses is participating in whole life insurance, but the real goal is controlling the banking function in one’s own life.

Banking is the process of saving and deploying capital. So why let the banks profit from your money when you could manage that function yourself?

That’s what Richard teaches: how to keep your money growing, compounding, and accessible.

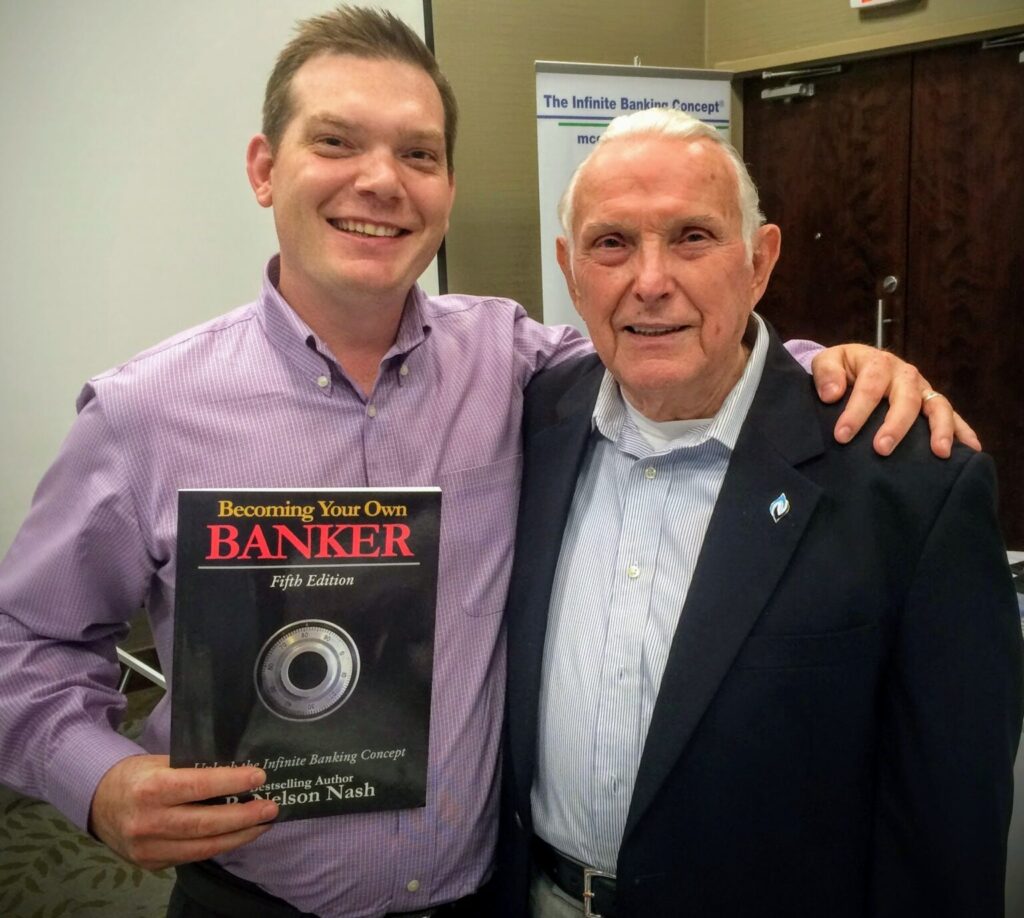

In 2012, he built a close mentorship with Nelson Nash, the founder of the Infinite Banking Concept. Nash called Richard “a genius at teaching it” and said he understood the system better than anyone he’d worked with.

Richard was the 11th person globally to be certified by the Nelson Nash Institute. He still serves on their council and mentors others to keep Nash’s original message intact. He even co-produced a documentary in 2017 to preserve the founder’s legacy.

Today, through Ascendant Financial, Richard works with people who want to take control. He looks for clients who ask questions, show up to webinars, and apply the principles themselves.

It’s about building a community of people who want to own their financial system.

Getting the Word Out: Books and Broadcasts

Besides teaching one-on-one, Richard and Jayson Lowe have built content that scales.

Books

They’ve co-authored books like Canadians’ Guide to Wealth Building Without Risk, Cash Follows the Leader, and Don’t Spread the Wealth.

Each tackles a different angle, from the basics to setting up family banking systems.

These books hit bestseller lists on Amazon and USA Today.

Richard also contributed to Financial Blind$pot$, sharing deeper insights on money traps.

Podcast

In 2020, Richard and Jayson launched Wealth Without Bay Street. I joined Richard on an episode to discuss challenges local business owners face, and what stood out to me was how engaged their audience is.

In 2024, they rebranded the show to Wealth On Main Street. That name says something about their audience. It’s not about taking a stand against institutions but reaching real people with useful insights.

Richard’s not just focused on his own platform either. He’s been invited onto major financial podcasts, including BetterWealth, hosted by my friend Caleb Guilliams. Caleb is someone I trust, and when I saw Richard on his show, I knew it meant something. After their interview, Caleb said,

“Richard Canfield thank you so much and I look forward to having you back.”

That’s the kind of feedback Richard earns: thoughtful, respected, and worth bringing back.

Richard was also featured on the Infinite Banking Initiative podcast, which is produced by the Nelson Nash Institute. That appearance added important context to his journey with IBC. In Richard’s words:

“I had the honor of being hosted on the Infinite Banking Initiative podcast… During the conversation, I shared my journey with the Infinite Banking Concept and the profound impact of Nelson Nash’s book, Becoming Your Own Banker.”

He was joined by David Stearns, President of Infinite Banking Concepts, and Leigh Barganier, the podcast host, for an in-depth discussion on how the book fundamentally changed his financial trajectory.

Why Richard Canfield Resonates

Real-world background:

Richard came from the trades, real estate, and small business, which makes his message relatable.

Credibility from the source:

Nelson Nash certified him early and called him one of the best teachers of Infinite Banking. That carries weight.

“Richard understands this system as well as or better than anyone I’ve ever taught… he’s a genius at teaching it to others.” Nelson Nash.

Focus on control:

Most people feel out of control of their money. Richard flips that. He teaches how to manage your own capital, not just chase returns.

Respected by peers:

Jayson Lowe calls him genuine and sharp. Curtis Arnold talks about the mentorship he’s provided. People I respect trust him. For example, my friend Kim Butler, whom I have known for a long time, discussed “Overcoming Financial Difficulties and Redefining Retirement” with Richard.

It works:

Clients talk about hitting their goals faster, building long-term stability, and sleeping better at night.

I’ve seen him speak alongside people like Rabbi Daniel Lapin, breaking down complex ideas and helping people think clearly about their finances.

Richard helped me rethink how I handle money, not with theory, but with clear, consistent action. If you’re looking for someone who has done the work and can help you do the same, you won’t find many better.