I asked Google’s AI to find every negative review about Dental Revenue. It returned 26 pages of clear, sourced and verifiable information, including reviews, audit data, and client complaints.

While other AI tools focus on generating random content, the power of Google’s own AI in finding facts is better than any other AI tool. This makes it more effective, especially when real money and client trust are at stake.

This post shares what we found about the digital marketing agency that misled Dr. Hugh Flax. We also recorded a live Zoom audit reviewing the Flax Dental website and their ad accounts, where we uncovered several issues in real time.

Executive Summary

This report synthesizes publicly available negative feedback, criticisms, and documented performance issues concerning the dental marketing agency known as Dental Revenue. Based on an analysis of specific online review platforms, a third-party performance audit detailed in an online article, and contextual information from related industry discussions, several recurring themes of concern emerge.

Key findings indicate potential risks associated with the agency’s performance relative to client expectations and return on investment (ROI), the rigidity of its contractual terms and difficulties encountered during termination, the quality and relevance of leads generated, and the technical execution of core digital marketing services such as Search Engine Optimization (SEO) and Pay-Per-Click (PPC) advertising.

A notable disconnect between agency-reported metrics and client-experienced reality was observed in the available case study data. While positive testimonials for Dental Revenue exist, the severity and nature of the documented criticisms warrant careful consideration and thorough due diligence by prospective clients. This report aims to provide an objective overview of these potential risks to inform decision-making.

Introduction

Purpose and Scope

The primary purpose of this report is to consolidate and analyze publicly available negative reviews, criticisms, and documented performance issues pertaining to the marketing agency “Dental Revenue”. The objective is to provide prospective clients, typically dentists or dental practice managers, with a focused overview of potential risks and areas requiring careful scrutiny before engaging the agency’s services. This analysis concentrates exclusively on negative feedback and documented problems to support comprehensive due diligence.

It is important to clarify the scope: this report focuses specifically on “Dental Revenue,” the marketing agency. The research encountered mentions of similarly named entities, notably “Dental Revenue Group” (DRG), which appears to primarily offer dental billing and Revenue Cycle Management (RCM) services.1 While one source lists DRG as offering marketing strategy 6, the preponderance of evidence suggests it operates mainly in the billing/RCM space. Therefore, unless explicitly indicated or discussing general business practices applicable across sectors, findings related to DRG are considered distinct from the marketing agency “Dental Revenue” that is the subject of this report.

Methodology

The findings presented herein are based on information gathered from several sources as specified in the initial request. These include:

- Review platforms: Searches were conducted for reviews of “Dental Revenue” on UpCity, Google Reviews, Yelp, Better Business Bureau (BBB), and Glassdoor. The analysis prioritizes negative reviews (e.g., 1-star or 2-star ratings) and detailed complaints.

- Third-party audit analysis: Content from an online article published by BlitzMetrics, detailing a “Live Audit” of marketing performance for a client identified as Dr. Hugh Flax, was analyzed for specific criticisms and alleged issues. Dr. Flax’s practice, Flax Dental, is listed as a client on Dental Revenue’s website, supporting the attribution of the audit findings to this agency.

- Other online sources: Searches were conducted for additional online discussions, forum posts, blog entries, or articles mentioning negative experiences or controversies related to Dental Revenue. Contextual information regarding general dental marketing challenges, contract issues, and potential scams was also drawn from various sources discussing the broader industry.

The synthesis focuses on recurring themes and specific examples of dissatisfaction or alleged problems identified across these sources.

Importance of Due Diligence

Selecting a marketing partner is a significant decision for any dental practice, involving substantial financial investment and impacting patient acquisition and practice growth. Analyzing negative feedback, alongside positive testimonials, is a crucial component of due diligence. Online reviews, while requiring critical assessment for authenticity and context, provide valuable insights into potential pitfalls, common client frustrations, and agency performance issues.

Understanding these potential risks, such as contractual complexities, performance discrepancies, or service quality concerns, allows prospective clients to ask targeted questions, negotiate more effectively, and make a more informed decision, ultimately mitigating potential financial loss and reputational damage associated with an unsuitable marketing partnership.

Analysis of Negative Online Reviews

Platform Overview

The investigation searched for negative reviews of Dental Revenue (the marketing agency) across several specified platforms: UpCity, Google Reviews, Yelp, Better Business Bureau (BBB), and Glassdoor. The availability of relevant reviews within the provided information varied significantly:

- UpCity: One detailed, verified 1-star review was found and analyzed.

- Google Reviews: While Dental Revenue encourages clients to leave Google reviews, and positive testimonials exist on their own site referencing Google, no specific negative Google reviews for the marketing agency were identified in the supplied data. Contextual mentions of Google reviews appear generally or relate to other entities.

- Yelp: Discussions on Yelp’s general relevance and potential issues for businesses, including dentists, were found. However, no specific Yelp reviews, positive or negative, for the Dental Revenue marketing agency were present in the research materials. Numerous snippets referenced Yelp reviews for Dr. Flax’s dental practice, not the marketing agency.

- Better Business Bureau (BBB): Information regarding BBB profiles and ratings for other dental-related or revenue cycle businesses was found, along with general information about the BBB. No BBB profile, complaints, or rating specific to the Dental Revenue marketing agency were identified in the provided data.

Therefore, the primary source of direct negative client feedback within this dataset comes from the single UpCity review.

Detailed Analysis of UpCity 1-Star Review

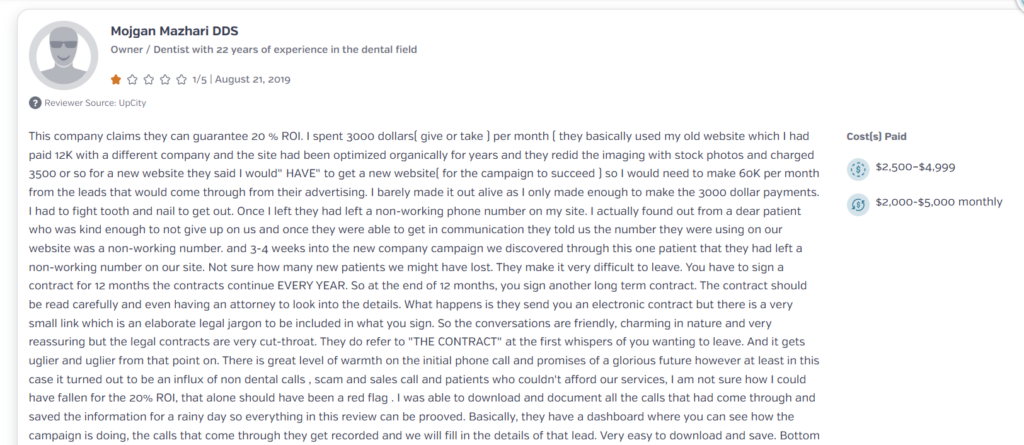

A single, verified 1-star review on UpCity provides a detailed account of a client’s negative experience with Dental Revenue. The reviewer outlines several significant complaints:

- Financial Discrepancy and Unmet ROI Promises: The client reported spending approximately $3,000 per month on Dental Revenue’s services. Despite this investment, the revenue generated was barely sufficient to cover these monthly payments. This fell drastically short of a purported 20% Return on Investment (ROI) guarantee, which the reviewer calculated would have required generating $60,000 per month in revenue directly attributable to the agency’s marketing efforts. The reviewer explicitly labels such elaborate ROI guarantees as manipulative and a red flag.This highlights a critical disconnect between promised outcomes and actual financial results experienced by this client.

- Website Development and Cost Issues: A major point of contention involved the client’s website. The reviewer alleges that Dental Revenue initially utilized their pre-existing website, which had been professionally built by another company at a cost of $12,000 and organically optimized over several years. Dental Revenue allegedly replaced existing imagery with stock photos. Subsequently, the agency reportedly pressured the client into purchasing a “new” website for an additional $3,500, claiming it was essential for the campaign’s success. This raises concerns about transparency, value proposition, and potentially unnecessary upselling.

- Contractual Problems and Termination Difficulties: The review describes a mandatory 12-month contract that automatically renews annually, making disengagement difficult. The reviewer stated they had to “fight tooth and nail” to terminate the agreement. A specific warning is issued regarding the electronic contract containing a “very small link” leading to extensive legal jargon, suggesting terms may not be immediately apparent or easily understood. The reviewer characterized the initial sales interactions as friendly and reassuring, but the legal contract and the process of attempting to leave as “very cut-throat,” with the agency immediately referencing “THE CONTRACT” upon the client expressing dissatisfaction. This aligns with broader industry complaints about inflexible long-term marketing agreements.

- Post-Termination Service Issues: After successfully terminating the contract, the client discovered that Dental Revenue had left a non-working phone number on their website. This error persisted for 3-4 weeks into the client’s engagement with a new marketing company and was only identified when a persistent patient alerted the practice. This oversight potentially resulted in the loss of new patient leads during the transition period. This indicates a lack of care or potential negligence during the offboarding process.

- Poor Lead Quality: Despite promises of a “glorious future,” the client experienced an influx of low-quality leads, including non-dental calls, scam calls, sales solicitations, and inquiries from individuals unable to afford the practice’s services. This suggests a failure in targeting the desired patient demographic, leading to wasted resources and administrative burden in filtering irrelevant contacts.

- Concerns Regarding Review Authenticity: The reviewer noted observations about Dental Revenue’s positive reviews, specifically mentioning that many positive reviews on the agency’s Facebook page appeared to be authored by employees. They advised prospective clients to seek out and prioritize reviews from genuine, long-term clients. This resonates with general industry concerns about the potential for review manipulation.

- Reviewer’s Recommendations: Based on their experience, the reviewer offered several pieces of advice: be skeptical of high ROI guarantees; favor shorter contract terms (e.g., 6 months) with clear, performance-based exit clauses allowing termination with reasonable notice if results decline; meticulously review all contract terms, potentially with legal counsel; consult a diverse range of reviews beyond agency-provided references; and expect transparency and accountability from marketing partners, including the ability to easily disengage if promised results are not achieved.

Significance of the Single Negative Review

Although originating from a single reviewer within the dataset provided, the UpCity 1-star review carries significant weight due to its detailed nature and the breadth of serious issues raised. It outlines a narrative encompassing performance failures (ROI, lead quality), contractual disputes, service delivery problems (website, post-termination phone number), and ethical concerns (pressure, review authenticity).

While one review does not definitively prove systemic issues, the severity of the alleged negative impact – substantial financial loss and significant operational disruption attributed directly to the agency – makes this data point highly relevant for risk assessment. The lack of corroborating negative reviews within the provided snippets means a pattern cannot be confirmed from this dataset alone, but the potential for such severe negative outcomes warrants caution.

Potential Contractual Rigidity as a Key Risk

The UpCity reviewer’s detailed description of the 12-month, auto-renewing contract, coupled with the alleged difficulty and unpleasantness of termination, highlights contractual rigidity as a significant potential risk factor. This structure inherently benefits the agency if performance falters, potentially locking clients into extended periods of paying for unsatisfactory results.

The reviewer explicitly links the difficult contract terms to their negative financial outcome and frustration. This perceived inflexibility stands in contrast to the desire for adaptable agreements, particularly when marketing outcomes are uncertain. The combination of alleged underperformance and restrictive contract terms emerges as a primary concern based on this feedback.

Findings from Third-Party “Live Audit” Analysis (BlitzMetrics Article)

Context

Further insights into potential performance issues stem from an online article published by BlitzMetrics, which details a “live audit” of marketing performance conducted for Dr. Hugh Flax, an Atlanta-based cosmetic dentist. Dr. Flax’s practice, Flax Dental, is listed as a client on Dental Revenue’s own website, strongly suggesting the audit pertains to Dental Revenue’s services for this client.

The audit, conducted by marketing experts Dennis Yu and David Meerman Scott, was initiated because Dr. Flax was spending $6,000 per month on marketing but reported seeing no return on investment (ROI). While the BlitzMetrics article itself does not name the agency, the combination of the client’s identity, the context of the audit (dental marketing agency performance review), and the client’s presence on Dental Revenue’s portfolio page allows for the attribution of the audit’s findings to Dental Revenue’s work for Dr. Flax.

Specific Criticisms from the Audit

The audit conducted by BlitzMetrics revealed several specific deficiencies and areas of concern regarding the agency’s performance for Dr. Flax:

- Poor SEO Performance and Strategy: The audit found no evidence of effective link building. Existing backlinks were characterized as old and originating from low-quality directories, many irrelevant to the dental field. Crucially, there was a lack of meaningful growth on high-intent local keywords essential for attracting new patients, such as “Atlanta cosmetic dentist” or “emergency dentist near me.” The analysis indicated that the website traffic primarily came from searches for Dr. Flax’s name, suggesting his existing reputation and Google Business Profile were the main drivers, rather than the agency’s SEO activities. Furthermore, the agency’s head of marketing reportedly dismissed the importance of link building, considering it PR-driven, a stance contested by the auditors.

- Lack of Quality Content and EEAT Compliance: The website was found to be deficient in robust, localized service pages targeting specific geographic areas like Sandy Springs. An existing page for “Emergency Dentistry in Sandy Springs” was assessed as having no Expertise, Experience, Authority, or Trust (EEAT), failing to meet Google’s quality standards for such content. Instead of showcasing actual dental work with examples, images, or videos, the content was described as consisting of keyword-stuffed Frequently Asked Questions (FAQs).

- Ineffective Google Ads Management: Examination of the Google Ads account revealed very low Quality Scores (rated 1 and 2 out of 10) for top-spending, high-value keywords like “dentist near me” and “Atlanta dentist.” Low Quality Scores typically result in higher costs per click and reduced ad visibility. The audit also criticized the campaign structure as being too shallow, lacking tightly themed ad groups aligned with specific dental services and corresponding relevant landing pages, which is a best practice for maximizing ad relevance and performance.

- Misaligned Lead Generation and Poor Quality: The agency reported generating 520 leads (calls and form submissions) over the previous 12 months. However, a manual review conducted by Dr. Flax’s office staff (Edie) determined that very few of these leads aligned with the practice’s agreed-upon target patient profile – specifically, high-value cosmetic dentistry cases located in Atlanta and Sandy Springs. The practice received many leads from outside the target geographic area or for low-intent inquiries (e.g., simple questions rather than appointment requests). This occurred despite the practice having clearly communicated its expectations regarding target patients early in the engagement. This finding mirrors the lead quality complaints raised in the UpCity review.

- Disputed ROI and Revenue Attribution: A significant discrepancy arose regarding the financial impact of the agency’s work. The agency claimed to have generated nearly $100,000 in total production revenue, referencing internal reports showing figures like $67,000, $18,000, $54,000, and $36,000 for specific months. Dr. Flax strongly contested this figure, stating that it did not align with his actual collections or patient volume and that significant cases during that period originated from referrals, not the agency’s marketing. The auditors, including David Meerman Scott, also questioned whether the agency’s claimed revenue figures, even if accurate, justified the $6,000 monthly expenditure. This points to a fundamental disagreement on the value delivered and echoes the unmet ROI promises mentioned in the UpCity review.

- Operational Issues During Performance Dispute: The situation escalated to the point where the agency paused most marketing campaigns because Dr. Flax had stopped payments due to the lack of results. Despite the paused campaigns and the underlying performance dispute, the agency reportedly demanded payment of outstanding invoices before they would release control of the website and associated data to the client. This suggests potential difficulties in disengaging from the agency and retrieving critical business assets, even amidst documented performance failures, reflecting the contractual concerns raised in the UpCity review.

Disconnect Between Agency Reporting and Client Reality

A critical observation emerging from the BlitzMetrics audit is the apparent disconnect between the metrics reported by the agency and the actual results experienced by the client. The agency highlighted lead volume (520 leads) and internally tracked production revenue figures (totaling ~$100k). However, the client’s reality, confirmed through manual review and financial assessment, involved poor lead quality (few matched the target profile) and disputed revenue attribution (actual collections did not reflect the claimed figures, large cases came from referrals).

This suggests the agency’s reporting may have focused on potentially misleading or “vanity” metrics, such as raw lead count, rather than metrics directly reflecting the client’s primary goal: acquiring high-value patients and achieving a positive, verifiable ROI based on actual collected revenue. Such a disconnect inevitably fuels client dissatisfaction and disputes over performance and value, as evidenced in both the audit case and the UpCity review. This underscores the necessity for clients to insist on transparent, mutually agreed-upon reporting focused on bottom-line impact.

Potential Deficiencies in Core Marketing Execution

The specific criticisms raised in the audit point towards potential fundamental deficiencies in the agency’s execution of core digital marketing services. Issues identified, such as a weak backlink profile, content lacking EEAT, low Google Ads Quality Scores, and poorly structured campaigns, are not merely strategic disagreements but relate to the basic technical implementation of SEO and PPC advertising.

These findings suggest that the agency, in this specific case, may have lacked the necessary technical expertise, adherence to best practices, or resource allocation to deliver high-quality digital marketing services. Such execution failures would directly contribute to the poor performance outcomes observed – namely, the lack of relevant organic traffic and the generation of low-quality, misaligned leads. This contrasts sharply with the image of expertise and high-quality results often projected by marketing agencies, including the positive testimonials featured by Dental Revenue itself.

Criticisms from Other Online Discussions and General Context

Forum/Blog Search Results

Beyond the detailed UpCity review and the BlitzMetrics audit article, the provided research materials did not contain specific forum posts, blog entries (other than BlitzMetrics), or news articles detailing negative experiences or complaints specifically about the Dental Revenue marketing agency. Searches for terms like “Dental Revenue complaints forum” or “Dental Revenue problems blog” yielded articles discussing general dental billing issues, RCM problems, common patient complaints, or challenges faced by dentists and DSOs, often involving other companies or general industry trends.

Similarly, searches for “Dental Revenue lawsuit” or “Dental Revenue scam discussion” returned articles about lawsuits involving other dental entities (like Zelis, Benevis/Kool Smiles, Delta Dental, Great Expressions, Align Technology, Aspen Dental, Dentsply Sirona) or general discussions about dental scams, fraudulent billing, and misleading advertising, none specifically naming Dental Revenue marketing agency. Searches for reviews on Clutch.co yielded profiles for Dental Revenue Group (billing) and Dental Revenue (marketing agency, listed under social media marketing for the dental industry) but without any client reviews displayed in the provided snippets. G2 reviews were mentioned in the context of other platforms but not specifically for Dental Revenue.

General Marketing Complaints Context

While specific complaints about Dental Revenue beyond the UpCity review and the audit article were scarce in the provided data, the broader context of challenges in dental marketing provides a framework for understanding the potential significance of the issues raised:

- ROI and Performance Issues: Achieving a clear ROI from marketing expenditures is a common challenge for dental practices. Failure to track relevant Key Performance Indicators (KPIs) can mask underperformance and lead to missed growth opportunities. Issues in the revenue cycle, such as high claim denial rates or inefficient patient billing, underscore the importance of marketing efforts attracting not just leads, but the right kind of patients who can convert and contribute positively to the practice’s financial health. Marketing is essential, but its effectiveness must be demonstrable, and declining patient numbers despite marketing spend is a clear warning sign.

- Contractual Issues: The potential pitfalls of long-term, inflexible marketing contracts are a recognized concern, especially when results are not guaranteed. General advice cautions against agreements with opaque legal terms or difficult exit clauses. Practices may also face internal resistance or operational hurdles when attempting to change service providers.

- Service Quality and Communication: Frustrations with poor communication, lack of responsiveness, and slow turnaround times from marketing agencies are prevalent enough that some clients switch providers seeking improvement. A lack of transparency in reporting and methodology can erode trust. Furthermore, agency-side issues like staffing shortages or inadequate expertise can directly impact the quality of service delivered to the client.

- Misleading Practices and Ethical Concerns: The marketing industry, including the dental sector, is not immune to misleading practices. Warnings against guarantees that seem “too good to be true” and concerns about the authenticity of online reviews are relevant. While distinct from marketing fraud, the existence of broader dental industry scams (e.g., unnecessary treatments, billing fraud) emphasizes the need for dentists to partner with ethical and trustworthy service providers in all aspects of their business, including marketing. Misleading advertising practices are also a specific area of concern within the dental field.

Distinction from Dental Revenue Group

It is crucial to reiterate the distinction between Dental Revenue (the marketing agency) and Dental Revenue Group (DRG). Numerous sources discuss DRG, identifying it as a provider of dental billing, RCM, credentialing, and related financial services. While one source lists DRG (based in Chicago) as offering Marketing Strategy and Social Media Marketing, the overwhelming focus in the data relates to its billing/RCM functions.

Therefore, negative feedback or issues potentially associated with billing companies should not be automatically attributed to the Dental Revenue marketing agency without concrete evidence linking the two entities or demonstrating shared problematic practices.

Potential for Misaligned Expectations and Communication Breakdowns

Considering the client complaints from the UpCity review alongside the detailed findings of the BlitzMetrics audit, a potential pattern of misaligned expectations and communication breakdown between Dental Revenue and its clients emerges as a significant underlying issue. The UpCity reviewer mentioned promises of a “glorious future” and a specific ROI guarantee that ultimately proved unrealistic, alongside receiving low-quality leads. Similarly, the audit revealed the agency reporting raw lead volume and disputed revenue figures, while the client (Dr. Flax) was focused on attracting specific high-value patients and measuring success based on actual collected revenue directly attributable to marketing.

This suggests a possible failure point occurring early in the client relationship, perhaps during the sales or onboarding process, where realistic, mutually understood goals, target patient definitions, and key performance indicators (KPIs) were not adequately established or agreed upon. If the agency defines and measures success differently from the client (e.g., focusing on website traffic or raw lead count versus qualified new patient acquisition and attributable revenue), dissatisfaction is highly likely, irrespective of contractual obligations. Effective communication, clear expectation setting, and agreement on meaningful metrics are vital for any successful agency-client partnership, and breakdowns in these areas appear to be implicated in the negative experiences documented.

Synthesis: Recurring Criticisms and Potential Risks

Based on the analysis of the available negative feedback from the UpCity review, the detailed third-party audit findings, and contextual information from broader industry discussions, several recurring themes of criticism and potential risk associated with the Dental Revenue marketing agency can be identified.

Consolidation of Key Themes

- Performance & ROI Deficiencies: A central theme revolves around the agency allegedly failing to deliver the promised or expected return on investment. This includes not meeting specific ROI guarantees, generating revenue figures disputed by the client and deemed insufficient to justify costs, and failing to attract the desired type of high-value patient cases. General industry context confirms that achieving and proving marketing ROI is a significant challenge.

- Contractual Rigidity and Exit Difficulties: Significant concerns were raised regarding the agency’s use of long-term (12-month), automatically renewing contracts.24 These contracts were described as difficult and unpleasant to terminate, even when performance was perceived as poor. Issues included complex legal jargon potentially hidden in electronic agreements and difficulties regaining control over website assets during disputes. This points to a potential risk of being locked into an underperforming agreement.

- Service Execution Quality: The third-party audit alleged specific technical deficiencies in the execution of core marketing services for Dr. Flax. This included substandard SEO practices (poor link building, content lacking EEAT) and ineffective Google Ads management (low Quality Scores, weak campaign structure). Such findings suggest potential gaps in technical expertise or quality control.

- Lead Quality and Targeting Issues: Both the UpCity review and the audit report highlighted issues with the quality and relevance of leads generated. Complaints included receiving a high volume of non-dental calls, inquiries from outside the target geographic area, or leads from individuals unable to afford the practice’s services, despite clear client expectations. This indicates potential problems with audience targeting and campaign optimization.

- Transparency and Reporting Concerns: The dispute over revenue attribution in the audit case suggests a potential lack of transparency or a disconnect between how the agency measures success and what the client values. The agency may focus on intermediate or vanity metrics (like lead volume) rather than bottom-line results (like qualified patient acquisition and collected revenue). Additionally, concerns about the authenticity of positive reviews were raised.

The following table summarizes these key negative themes and the primary sources supporting them:

| Theme | Evidence Source(s) | Specific Complaint/Finding Example |

| Performance & ROI Deficiencies | UpCity Review; Audit Article | Promised 20% ROI unmet; Generated revenue disputed by client and insufficient to justify $6k/month cost; Failure to attract target high-value patients. |

| Contractual Rigidity & Exit | UpCity Review; Audit Article | Mandatory 12-month, auto-renewing contracts; Allegedly difficult/unpleasant termination process; Complex legal jargon; Disputes over website control release. |

| Service Execution Quality | Audit Article | Poor SEO (low-quality links, no growth on key terms, lack of EEAT); Ineffective Google Ads (low Quality Scores, poor structure). |

| Lead Quality & Targeting | UpCity Review; Audit Article | Influx of non-dental calls, scams, geographically irrelevant leads, or leads unable to afford services, despite targeting instructions. |

| Transparency & Reporting | UpCity Review; Audit Article | Discrepancy between agency-reported revenue/leads and client’s reality; Potential focus on vanity metrics; Concerns raised about authenticity of positive reviews. |

Potential Ripple Effects/Broader Implications

The issues highlighted in the negative feedback and audit could have broader implications for a dental practice beyond the immediate marketing results:

- Financial Strain: Investing significant monthly fees ($3,000 to $6,000 per month cited) into a marketing service that does not yield a commensurate return can put considerable financial pressure on a dental practice, impacting profitability and cash flow.

- Opportunity Cost: Engaging with an underperforming agency consumes valuable time and financial resources that could have been allocated to a more effective marketing partner or other practice growth initiatives.

- Operational Disruption: Problems arising during or after the engagement, such as non-functional contact information being left on a website or disputes over the release of website control and data, can cause significant operational disruptions, waste staff time, and potentially harm the practice’s ability to attract new patients.

- Erosion of Trust: Negative experiences involving unmet promises, perceived contractual entrapment, lack of transparency, and disputed results can significantly erode a dentist’s trust, not only in the specific agency involved but potentially creating skepticism towards the digital marketing industry as a whole.

Conclusion and Recommendations

Summary of Risks

The analysis of available negative feedback concerning the Dental Revenue marketing agency reveals several potential risks for prospective clients. These include:

- Financial Risk: The possibility of significant financial investment without achieving the desired or promised return on investment, compounded by potentially rigid long-term contracts that may be difficult to exit even in cases of underperformance.

- Lead Generation Risk: The risk of receiving leads that are poorly qualified, geographically irrelevant, or mismatched with the practice’s target patient profile and service focus, leading to wasted resources.

- Service Quality Risk: Potential deficiencies in the technical execution of core digital marketing services like SEO and Google Ads, potentially stemming from inadequate strategy, expertise, or quality control.

- Relationship and Exit Risk: The possibility of encountering difficulties in communication, lack of transparency in reporting, and facing an unpleasant or operationally disruptive process when attempting to terminate the relationship or retrieve business assets.

Recommendations for Prospective Clients

Based specifically on the criticisms and potential risks identified in the analyzed sources regarding Dental Revenue, prospective clients should consider the following actions during their due diligence process:

- Scrutinize ROI Claims and Performance Metrics: Question any specific ROI guarantees, particularly high percentage figures. Demand absolute clarity on how ROI is defined, calculated (e.g., attributed production vs. actual collections), tracked, and reported. Request anonymized, verifiable case studies from long-term clients with similar practice goals and market conditions.

- Conduct Thorough Contract Review: Pay meticulous attention to the contract duration, renewal clauses (especially automatic renewals), termination conditions, and notice periods. Carefully examine any referenced or linked documents containing additional legal terms. Strongly consider having legal counsel review the agreement before signing. Attempt to negotiate shorter contract terms (e.g., 6 months initially) or include specific performance benchmarks that trigger an option for early termination without penalty.

- Demand Service and Strategy Transparency: Request detailed explanations of the proposed SEO strategy, explicitly asking about their approach to link building and ensuring content meets Google’s EEAT guidelines. Inquire about Google Ads management practices, including campaign structure philosophy and how Quality Scores are monitored and improved. Insist on regular, detailed reporting that goes beyond raw lead numbers, focusing on metrics like qualified lead volume, cost per qualified lead, and conversion tracking through to patient acquisition.

- Verify Lead Quality Definition and Tracking: Clearly articulate and document the target patient profile (demographics, desired services, geographic focus). Establish mutual agreement on how lead quality will be defined, measured, and reported. Ask about the agency’s processes for filtering out irrelevant or low-quality inquiries before they reach the practice.

- Investigate the Exit Process: Ask direct questions about the procedures and requirements for contract termination, including the handover of all website files, data, account access (e.g., Google Ads, Analytics), and domain name control. Ensure the contract clearly states the client’s ownership of these assets.

- Seek Diverse and Independent Feedback: Do not rely solely on references provided by the agency. Actively search for independent reviews across multiple platforms (understanding the limitations and potential biases of each). If possible, seek candid feedback from current or former clients, particularly those who may have terminated their relationship with the agency. Be aware of the potential for manipulated or employee-written reviews.

Concluding Statement

Thorough due diligence is paramount when selecting a dental marketing partner. While Dental Revenue showcases positive client testimonials and is listed as a provider by industry resources, the documented negative experiences detailed in the UpCity review and the critical findings from the third-party audit of their work for Dr. Hugh Flax highlight significant potential risks. These risks encompass performance, contractual obligations, service quality, lead generation, and transparency.

Prospective clients are strongly advised to carefully weigh these documented concerns against any positive feedback and to rigorously investigate the areas highlighted in the recommendations before committing to an engagement with Dental Revenue.